Front running recurrent flows. A trading strategy.

One of the most common operations we apply to data involves slicing it up to check for any seasonality effects. This method can reveal anomalies that informs an edge we can build off of.

Let's walk through how this process worked on one of the most actively traded instruments globally - U.S. Treasury bonds. Since directly trading bonds comes with friction for most individual investors, we'll use IEF, an ETF tracking medium-term Treasuries, as a proxy for analysis.

For simplicity, we'll only use its daily open prices to compute daily returns.

Let’s slice the data up and check if there are recurring flows we can front run. We’ll do this by computing returns of being in a long position (bonds go up in the long run so we’re not looking to short it) over t days, where t < 10, leading up to the last trading day of the month. This is done by:

We then slice the results into test and validation sets to test out our model. The heatmap shows computed Sharpe ratios for different values of t:

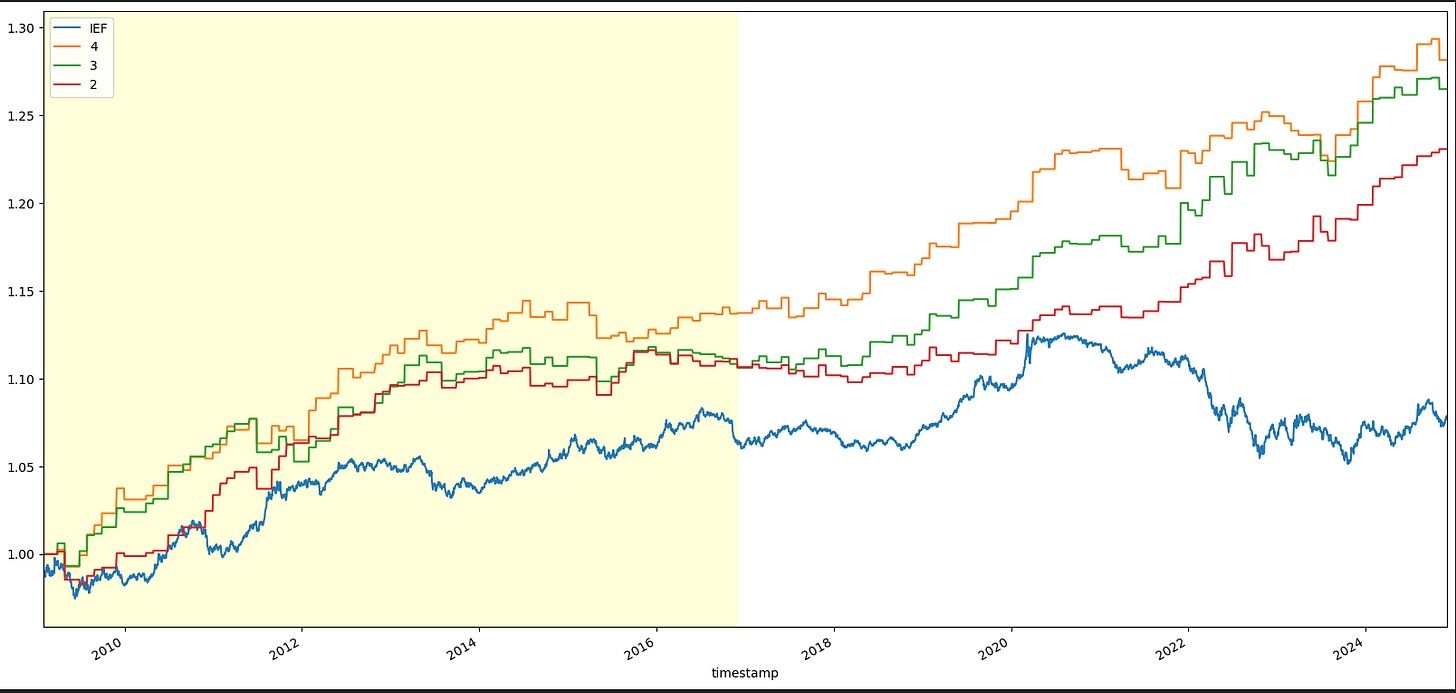

The in-sample result has a nice and smooth gradient. Promising. Let’s then plot cumulative returns with data from the out-of-sample set.

Our backtest shows significant improvement in risk-adjusted return against the benchmark. Additionally, we only need to deploy capital for a number of days each month, allowing us to go after other juicy stuff the rest of the time, not to mention lower exposure to volatility — we would’ve been fine during the bond rout.

Is this strategy tradeable as-is? With some modifications, we'd say yes. The model assumes funding cost of leverage at 0%, no commission and trading costs. Those will have to be factored in.

Why do the returns exist?

Although guessing the reason behind this end-of-month anomaly is not quite possible, we have some thoughts:

It could be that a number of mutual funds indiscriminately/systematically bid up bonds at the turn of the month. This could stem from the routine contributions made by salary earners to their pensions as each month draws to a close. Another possibility is that fund managers need to report their holdings at month-end, and to appear responsible, they sell riskier assets to buy bonds. These large flows don't have equally matched orders on the other side, causing recurring flows which can be front-run.